Withholding tax rules are aimed to ensure tax is withheld from payments to companies and individuals who are primarily only supplying labour on a job, it can be a bit tricky to work out what rate to use and how it all works so we wrote a little explainer to help.

What is Withholding Tax?

Withholding Tax (WT) also known as tax on schedular payments, applies to freelancers or contractors for income earned from labour only contract work rather than salary or wages.

WT is deducted and paid by the company paying the contract, but the contractor still needs to file an income tax return declaring the income and any tax that has been paid or residual amount that is due. Some expenses can be claimed for against this income, check out this article about the potential for refunds for overpayments.

What industries does WT apply to?

Common industries where WT is compulsory includes labour only construction, IT and entertainment, there is a full schedule of industries available on the IRD website here. If you contact via a labour hire company then WT is compulsory also.

How does it work?

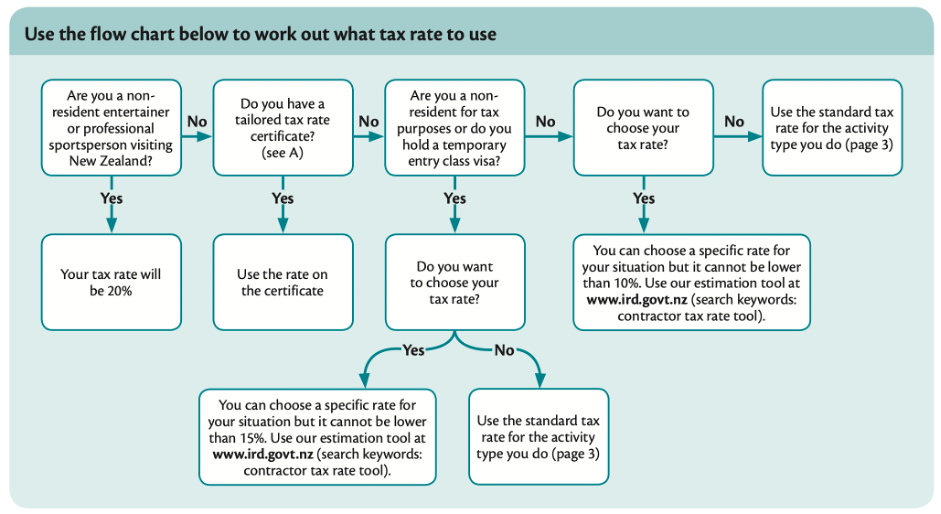

Contractors need to elect and notify a tax rate for their WT, use the flow chart below and check out specific activity rates on page 3 of the IR330C form here. The standard rate is 20%.

Contractors must complete an IR330C for each source of contracting income received.

Source: Page 2 of IRD IR330C form

You can apply for an exemption to paying tax via WT, but this can be hard to get approved unless you have a good history of making tax payments (which doesn’t include PAYE).

Note: a non-notified rate is 45%, so it pays to elect and notify a rate and have the use of your cash.

What traps should you watch out for?

- Electing a rate that is too low – Contractors need to be careful not to elect a rate that is too low (e.g., 10% minimum instead of 20%) if they are in fact a higher earner (Earning over $55K) as they will likely face a large tax bill at the end of the year.

If their residual tax outcome for the year exceeds $5,000, they will fall into provisional tax.

e.g. $100,000 earnings @ 10% w/tax rate (not considering any expenses)

Total tax bill = $23,920

WT deductions = $10,000

Residual tax bill = $13,920 (triggered for provisional tax in second year)

Contractors earning over $250,000 need to be especially careful as they can be caught out with UOMI (use of money interest) penalties.

- GST calculations and accounting software – Care needs to be taken when applying GST to income that is subject to WT and generally requires a manual journal adjustment to be accurate. The GST and WT should both be calculated from the original amount of $1000.

e.g. Labour = $1000

+ 15% GST = $150

Invoice total = $1150

– 20% WT = – $200

Payment received = $950 (need to put $150 GST aside)

In this scenario the software will deduct GST from the $950 payment ($123.91) but it will need a manual journal entry to reflect $150 instead.

Some contracts require the contractor to be GST registered even if they are not likely to earn over $60,000 per annum.

- Filing returns and other taxes – It is important to ensure you file a tax return at the end of the financial year. Kiwitax can do this for you, it takes just 2 minutes to get a quote here, or you can figure this out yourself.

Also be aware that as you are not paying PAYE as a contractor, you will need to factor in other costs such as your ACC earner’s levy. You will also need to work out and pay any student loan repayments or non-compulsory KiwiSaver contributions.

The bottom line is that you are responsible to ensure the correct rate is used and forms completed and returned.

About Kiwitax – Award winning business improvement, tax and accounting service

Here’s the thing. As a business, rental property owner or start-up, you get a kick out of having your own gig. But chances are dealing with your tax and accounting leaves you cold. Good news! We love it, so hand it over to Kiwitax and we’ll look after it all for you.

Whether you deal with us online, by phone or drop into our Napier office, you’ll find a friendly, professional hardworking team ready to work with you, however you keep track of your financial information and from wherever you do business. And all for a fixed price. It takes just two minutes to get a quote.

Plus if you’re at a loss to know how to improve aspects of your business – from growth planning to cashflow management, even tax debt and so much more – we’re all over that too. Our Business Improvement advisors can help you make a plan and put it into action.

Kiwitax are a preferred training provider for Business Improvement services through the Regional Business Partner Network Capability Voucher Scheme. This is a government funded scheme designed to boost business capability by providing funding of up to 50% of approved training programs with specified training providers up to a maximum value of $5000.

If you liked this article and want to make improvements in your business, with quarterly coaching sessions specifically tailored to support you to identify and achieve your business goals, lets chat!