As a business owner or property investor, you’re entitled to make a tax claim for depreciation, but what exactly does that mean?

In simple terms, depreciation is how you account for the loss in value of certain business assets over time. Since many business assets are used for several years, like vehicles, computers, or machinery, you generally can’t claim their full cost as an expense in the year you buy them. Instead, the cost is spread out and claimed gradually over the asset’s useful life.

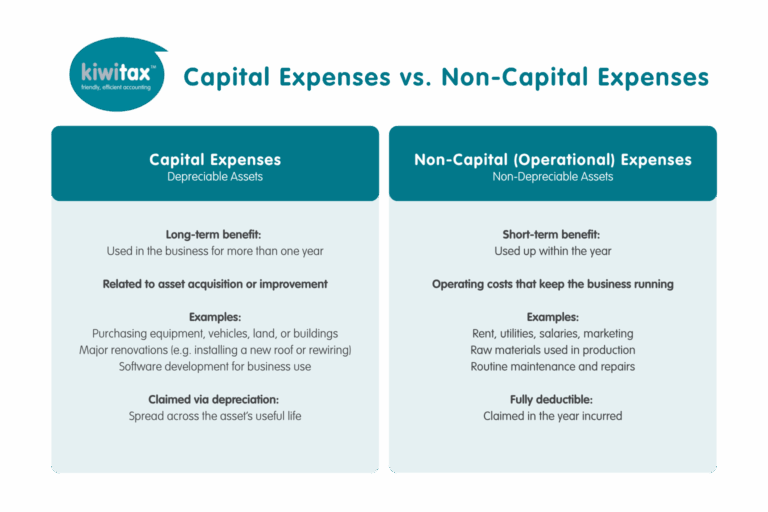

But before you even get to the point of claiming depreciation, it’s important to understand the difference between a capital expense (which may be depreciated) and a non-capital or operational expense (which is usually fully deductible right away). This distinction determines how the expense is treated for tax purposes and whether depreciation is even relevant.

Understanding What Determines a Depreciating Asset

Before you can claim depreciation, it’s essential to understand what qualifies an item as a depreciating asset. This typically depends on whether the cost is considered a capital expense or a non-capital (operational) expense.

A capital expense usually relates to the purchase or significant improvement of a long-term asset, something your business will use over time to generate income. These assets are not immediately deductible. Instead, their cost is spread out over several years through depreciation.

In contrast, non-capital expenses are part of your business’s regular operating costs, things like rent, electricity, and staff wages. These are generally deducted in full in the year they’re incurred and aren’t depreciated.

Current IRD Asset Thresholds

The asset threshold, set by IRD, is a guide to determining if something is a ‘capital asset’ and should be depreciated or if it should be treated as a ‘low value asset’. You can claim an immediate tax deduction for low value assets, instead of claiming depreciation over the asset’s life.

- Prior to 17 March 2020 = $500

- 17 March 2020 – 16 March 2021 = $5,000

- 16 March 2021 onwards = $1,000

From the month that you purchase the asset you can claim a percentage of it (based on IRD’s depreciation rates) as a tax-deductible expense which can be offset against your income (just like all other business costs).

So you don’t get to claim the whole cost at once, it’s spread out over a number of years.

Each year it’s worth reviewing your asset register to see if anything has broken, not able to be used anymore and we can then write this off fully giving you a tax claim on any residual balance.

As always if you’re not sure of anything please do contact us, we enjoy chatting with you

Pooling Assets For Depreciation

Lower-value assets can be grouped and depreciated as a pool. Once you include assets in a pool, you cannot remove them.

Pooled assets:

- Depreciation uses the diminishing value (DV)

- The lowest depreciation rate of the assets in the pool applies.

- Buildings cannot be included in a pool.

GST and Depreciation

- Registered for GST: Depreciation is based on the asset’s price excluding GST.

- Not registered for GST: Depreciation is based on the asset’s total price, including GST.

Depreciation Methods

There are two methods to calculate depreciation, and both result in the same total depreciation over the asset’s life:

- Diminishing Value (DV): Higher depreciation is claimed at the start of the asset’s life, decreasing each year.

- Straight Line (SL): Depreciation is consistent each year.

You can use different methods for different assets and may switch methods at the end of the tax year. If switching, calculate the new depreciation using the asset’s adjusted tax value*.

*the asset’s cost price, less all depreciation calculated since purchase.

Assets That Do Not Depreciate

Some assets do not depreciate including:

- land

- trading stock

- franchise fees

- residential buildings

- intangible assets, like goodwill.

About Kiwitax – Award winning business improvement, tax and accounting service

Here’s the thing. As a business, rental property owner or start-up, you get a kick out of having your own gig. But chances are dealing with your tax and accounting leaves you cold. Good news! We love it, so hand it over to Kiwitax and we’ll look after it all for you.

Whether you deal with us online, by phone or drop into our Napier office, you’ll find a friendly, professional hardworking team ready to work with you, however you keep track of your financial information and from wherever you do business. And all for a fixed price. It takes just two minutes to get a quote.

If you liked this article and want to make improvements in your business, with quarterly coaching sessions specifically tailored to support you to identify and achieve your business goals, lets chat!