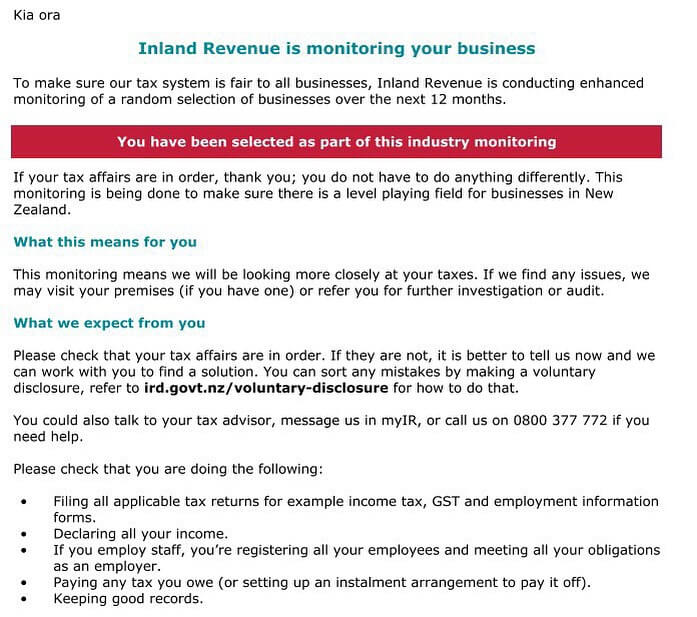

Recently, we have noticed that some clients have received notices from the Inland Revenue Department (IRD) stating that they have been randomly selected for closer monitoring. This appears to be part of a broader initiative, now that funds have been allocated by the government, to enhance data monitoring, pursue outstanding tax debt, and conduct audits. IRD appears to be focusing on specific industries to ensure tax compliance.

How IRD Monitors You/Your Business

The IRD employs various tools to track tax compliance and identify discrepancies in tax returns. They compare current tax returns with previous submissions and benchmark them against industry norms to detect anomalies that may warrant further investigation.

Additionally, the IRD has access to extensive third-party data, including:

- Merchant transaction data from EFTPOS providers

- Bank and investment records from both New Zealand and international institutions

- Property transaction data from Land Information New Zealand (LINZ)

- Cryptocurrency transactions

- International tax information-sharing agreements

- Data from online marketplaces such as Trade Me and Airbnb

Businesses Targeted

IRD has intensified its scrutiny of the “hidden economy,” particularly in industries where cash transactions are prevalent. These include sectors such as:

- Retail

- Hospitality

- Beauty

- Fitness

- Tattoo Artists

- Construction

- Fast food

As part of their efforts, the IRD has been conducting site visits to business premises to ensure accurate income reporting, correct classification of employees and contractors, and proper payment of PAYE (Pay As You Earn) taxes.

What Should You Do?

Don’t panic, you are not in trouble, and you are not the only one who received the notice regarding the monitoring. Take this as an opportunity to ensure you understand your tax obligations and take proactive steps now to keep yourself/the business compliant. Consider the following:

- Regularly review your financial records to ensure all income and expenses are accurately reported.

- Maintain detailed and organised records, including invoices, cash sales, receipts, and vehicle logbooks, to avoid complications during tax time.

- Talk to a professional – consulting an accountant can help you navigate tax compliance requirements and ensure you’re meeting your obligations. If you have received a notice that you are being monitored by IRD, make sure your accountant is aware of this.

Key Takeaways

- The IRD has expanded its compliance monitoring with access to data from various sources to allow them to pick up on anomalies.

- Those in industries with high cash transactions, such as retail, beauty (e.g. hairdressers), tattoo artists, fitness (e.g. personal trainers), construction, and hospitality, seem to be targeted.

- Keeping accurate records and staying informed about tax obligations can help prevent issues with IRD audits or investigations.

Need an accountant who will give you tax advice and keep you compliant with IRD?

Let’s chat!

About Kiwitax – Award winning business improvement, tax and accounting service

Here’s the thing. As a business, rental property owner or start-up, you get a kick out of having your own gig. But chances are dealing with your tax and accounting leaves you cold. Good news! We love it, so hand it over to Kiwitax and we’ll look after it all for you.

Whether you deal with us online, by phone or drop into our Napier office, you’ll find a friendly, professional hardworking team ready to work with you, however you keep track of your financial information and from wherever you do business. And all for a fixed price. It takes just two minutes to get a quote.

Plus if you’re at a loss to know how to improve aspects of your business – from growth planning to cashflow management, even tax debt and so much more – we’re all over that too. Our Business Improvement advisors can help you make a plan and put it into action.

Disclaimer

This article provides general information only and does not constitute professional tax advice. Tax laws and IRD policies may change, and the specifics of any case can vary. If you have concerns about your tax obligations or have received a notice from the IRD, it is recommended that you seek advice from a qualified accountant or tax professional.