We’ve had a number of customers asking how they can check and produce evidence to help them apply for the Covid-19 Wage Subsidy or Resurgence Support Payment. It’s also a requirement to keep these records when applying for the support packages. So, we thought we’d make a little “How to” to help.

Xero have a very handy report which makes comparing and storing this data easy. Check below for step by step instructions to produce this report.

Unfortunately, MYOB Essentials reports do not allow you to compare the custom periods required by MSD and IRD. You will need to produce a separate P&L report for each period and manually compare these to check your drop in revenue.

What information do you need to show?

Wage Subsidy:

A drop in revenue of at least 40% over the 14-day period 17 August 2021 to 30 August 2021, when compared to a typical 14-day consecutive period of revenue in the six weeks immediately prior to the move to Alert Level 4 on 17 August 2021.

If you are an employer that has highly seasonal revenue, you can show the drop when compared to the same 14-day period in 2020 or 2019. You will also need to demonstrate that the seasonal nature of your business makes it harder to meet the default method.

Resurgence Payment:

A drop in revenue of at least 30% over a 7-day period after an alert level increase and meet other eligibility criteria. This drop is compared to a typical seven-day period in the six weeks before the increase in alert level. Seasonal businesses should show a 30% revenue drop compared with a similar week the previous year.

Xero Reporting

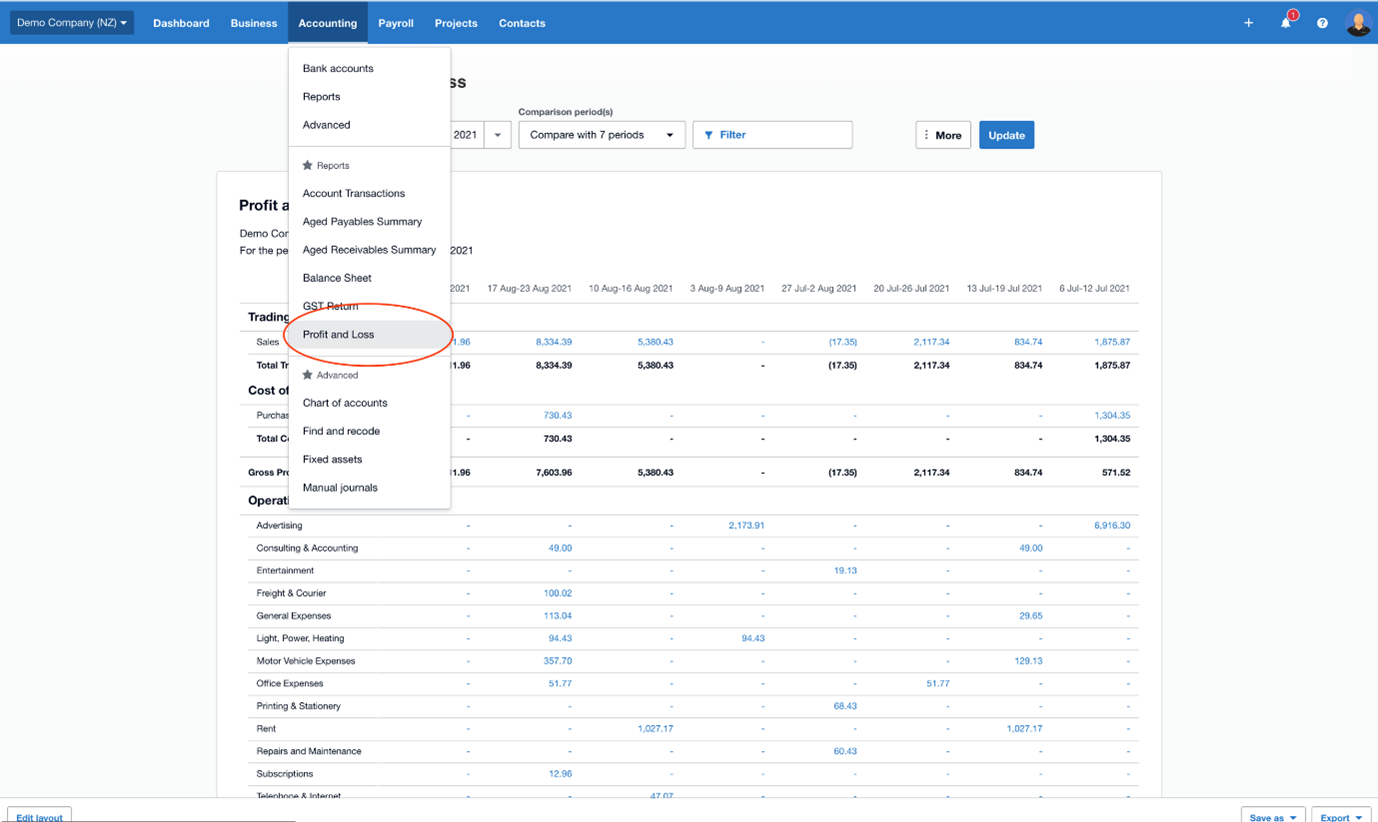

To produce the report, firstly navigate to the “Profit and Loss” report under the “Accounting” tab.

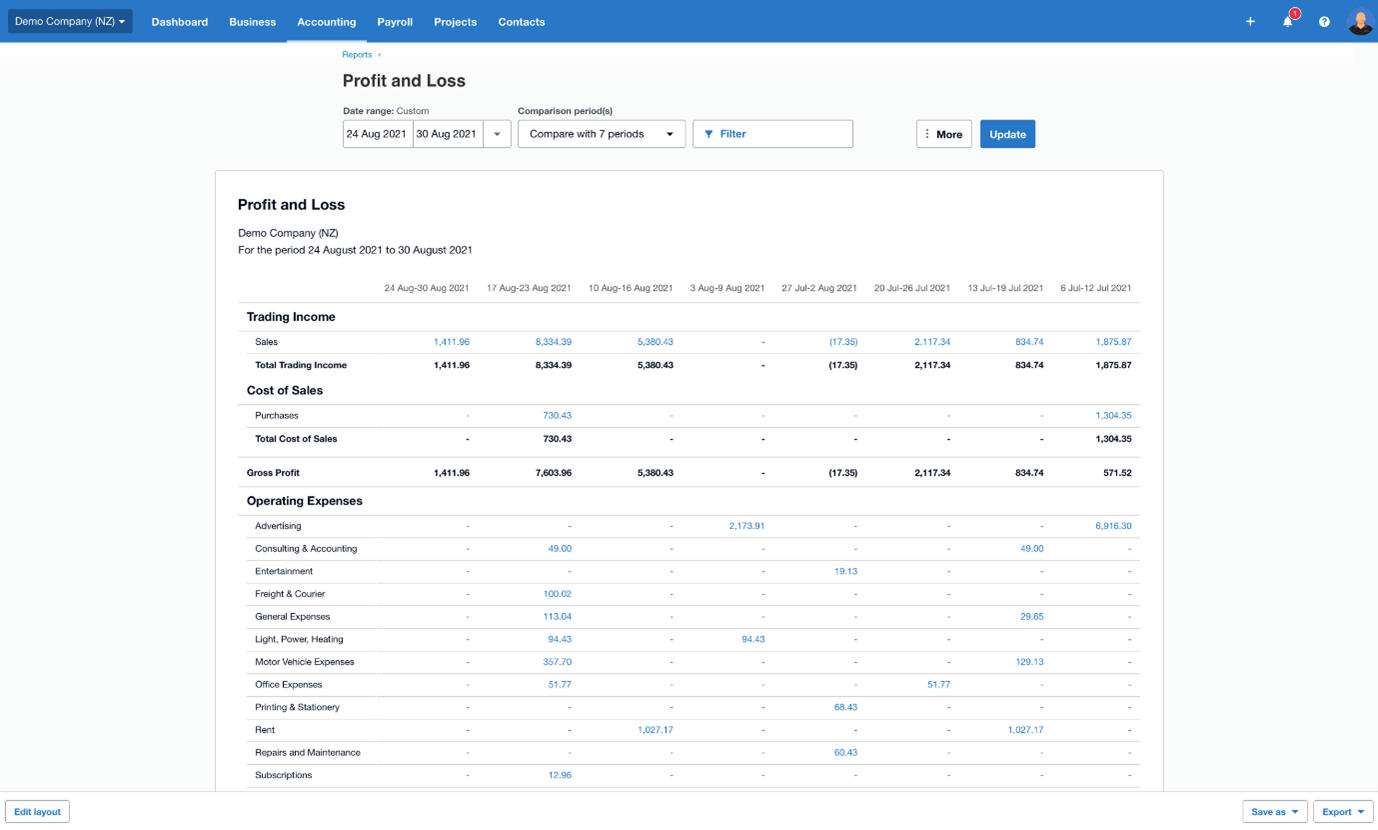

Then set the date range starting 24 August 2021 till 30 August 2021 (click on the date to get a date picker) and under “Comparison period(s)” select “Other” and enter “7” periods.

This will give you a weekly snapshot of your revenue “Trading Income” or revenue for the six weeks prior to lockdown and the 14-day period between the 17th and 30th August.

These reports can be based on Cash or Accrual basis.

For a cashflow business, such as a restaurant, this is likely to be the daily takings.

For a business that invoices clients, this will be the activities the business carries out that would entitle it to bill or invoice either immediately or at a later date.

You can then export this report as a PDF and save it for evidence by clicking the “Export” button at the bottom right-hand side.

For the RSP, Inland Revenue state: Both the affected revenue period and the comparison period must be calculated retrospectively. i.e. the calculations must be based on what has happened, not a forecast of what might happen.

Seasonal Business:

To show your revenue drop over a comparative period in the previous year, simply change the date range in the report above to suit the period you are looking to evidence a 30% drop in revenue for and adjust the comparison period/s also.

You can check out all of the requirements for wage subsidy applications on the declaration form here.

More details about the Resurgence Support payment can be found at IRD here.

If you are unsure what Covid-19 support is available for businesses check out this article

About Kiwitax – Award winning business improvement, tax and accounting service

Here’s the thing. As a business, rental property owner or start-up, you get a kick out of having your own gig. But chances are dealing with your tax and accounting leaves you cold. Good news! We love it, so hand it over to Kiwitax and we’ll look after it all for you.

Whether you deal with us online, by phone or drop into our Napier office, you’ll find a friendly, professional hardworking team ready to work with you, however you keep track of your financial information and from wherever you do business. And all for a fixed price. It takes just two minutes to get a quote.

If you liked this article and want to work with an efficient and helpful accountant, lets chat!