As of 1 April 2024, there are significant changes in the GST treatment for short-stay accommodations, especially for those using online platforms like Airbnb or other similar services. These changes are part of the New Zealand government’s effort to adapt tax regulations to the growing gig economy, impacting short-stay accommodation providers and ride-sharing services. In this article, we will break down what these changes mean, who they affect, and how you can adapt to avoid any future tax implications.

Key Changes for Short-Stay Accommodation Providers in 2024

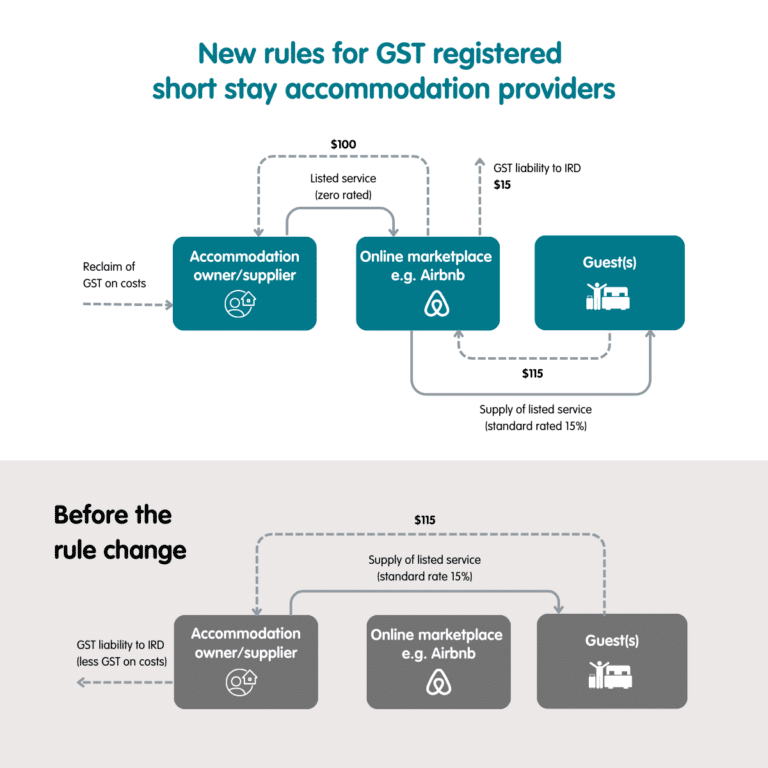

Since April 2024, any short-stay accommodation or service booked through an online platform, such as Airbnb/Uber, will be subject to a 15% GST, regardless of whether the provider is GST-registered. The online platform (such as Airbnb) will be responsible for collecting and paying this GST directly to Inland Revenue.

If you are a provider of short-stay accommodation or providing services through apps like Uber, this means that the platform will automatically handle GST on your behalf, even if you earn less than the $60,000 threshold for GST registration. This marks a shift from the previous system, where only GST-registered suppliers had to collect and pay GST.

In this article...

What Happens If You Are GST Registered?

If you are already GST-registered, here’s what you need to know:

- Zero-Rated Supplies: You no longer need to account for the 15% GST on accommodation booked through an online platform. Instead, these supplies will be reported in your GST return as zero-rated income.

- Claiming GST on Costs: You will still be entitled to claim GST on any costs incurred in running your accommodation business, just as before, this will result in these accommodation providers getting GST refunds in the majority of cases. However, you won’t receive any flat-rate credit from the platform.

- Tax Invoices: You are no longer required to issue tax invoices for these transactions, as the platform will handle this.

However, you must notify the platforms of your GST registration status to ensure that you are not mistakenly credited with the 8.5% flat rate, which applies to non-registered providers. If you receive the flat rate credit in error, it must be paid back to Inland Revenue, and failure to do so could result in penalties. This would be paid back to IRD by entering it in your GST return in the income adjustments section.

Note: If you are personally GST registered for other reasons e.g. sole trader, and personally/jointly own the accommodation property, it is important to seek advice from an accountant to ensure you have everything structured well to avoid any unnecessary tax implications.

What If You Are Not GST Registered?

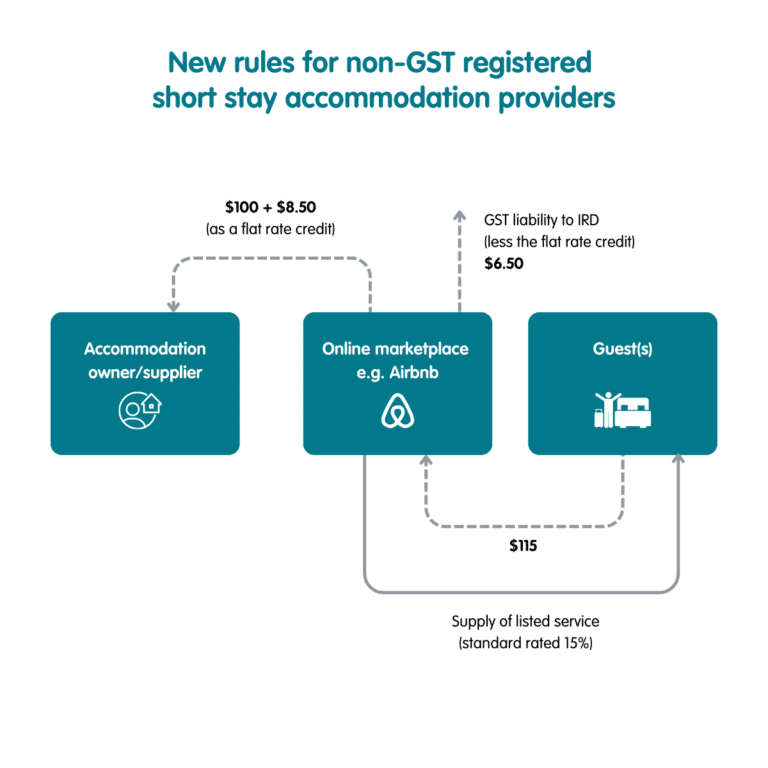

For providers who are not GST-registered, the new rules bring several changes:

- Flat Rate Credit: You will receive an 8.5% flat-rate credit from the platform, which is meant to compensate for the GST that would have been claimable on your property’s expenses. This credit will be automatically applied and passed on to you by the platform.

- No Need to Register for GST (In Most Cases): You do not need to register for GST simply because of this change. However, you should continue to monitor your income to ensure it stays below the $60,000 threshold. If your income exceeds this amount, you will need to register for GST and notify the platforms you work with.

- Impact on Property Sales: Importantly, this change does not mean your property is now part of the GST net. In the future, if you sell your property, it will not be subject to GST unless you are GST-registered for other reasons.

The Flat Rate Credit Explained

The 8.5% flat rate credit is a key part of the new rules for non-registered providers. This credit is designed to mirror the GST input credits that GST-registered providers can claim on their business expenses. Essentially, this means that if you are not GST-registered, the platform will withhold 15% GST from your income, but you’ll get 8.5% of that back as a credit.

However, this does mean your income from the platform will be reduced by the remaining 6.5% GST, so it’s important to adjust your pricing strategies accordingly.

Note (October 2024): The rules regarding how non-GST-registered providers can treat the flat-rate credit (and related expenses) are currently in the consultation stage and are subject to change in the future. It’s important to consult a professional to stay informed about any updates. Your accountant can help ensure your filings are compliant and advise on the best reporting methods to maximise your tax benefits.

Worried about navigating these changes for your short-stay accommodation?

Let’s chat!

Implications for Private Platform Providers

If you operate a platform that facilitates bookings for short-stay accommodations for multiple providers, it’s essential to have proper systems in place. You’ll need to keep track of the GST registration status of all your providers/clients and ensure that your platform/systems can handle GST collection and credit distribution efficiently.

Consider upgrading your platform’s functionality to automate this process, as relying on manual methods can be both time-consuming and prone to human error. Additionally, there will be changes to how you report GST in your filings, so it’s crucial to seek professional advice to ensure everything is handled correctly. At Kiwitax, we’ve developed tools specifically designed to help our clients manage these changes and ensure accurate calculations and reporting.

What If You’re a Property Manager Handling Multiple Listings on Platforms?

As a property manager listing accommodation on platforms like Airbnb for multiple clients, you’ll need to adjust your systems to stay compliant with the new rules.

If you’re GST-registered, all bookings you manage will have GST deducted by the platform. This means you must maintain records of each client’s GST status.

For clients who aren’t GST-registered, you’ll need to calculate the tax credit (56.67% of the occupancy tax figure withheld by the platform) and pass it on to them. Platforms like Airbnb will provide this tax information, making it easier for you to calculate and distribute the correct amount.

It’s important to itemise these tax credits in your statements, so your clients can accurately report their income in their tax returns.

If GST is taken from all bookings managed by a GST-registered property manager, and that manager must provide the 8.5% flat rate credit to their non-GST registered clients, their income will be reduced. However, that tax credit component can claimed back in the property manager’s GST return, so opting for monthly or two-monthly GST filings can help minimise the cash flow impact. This way, the extra cost is not carried for an extended period.

Large Operators and Opting Out

If you are a large operator—someone making more than $500,000 in taxable supplies in a 12 month period, or listing more than 2,000 nights of accommodation annually—you may be able to opt out of these platform rules. This would allow you to continue managing your GST obligations as did prior to 1st April, collecting and paying GST directly, rather than having the platform handle it.

Mixed Use Assets and GST on Disposal

The new rules also touch on the GST treatment for mixed-use assets, such as holiday homes used for both personal and rental purposes. If your property is primarily used privately, recent changes may allow you to exclude it from GST upon sale, provided certain conditions are met. This election is only available until 1 April 2025, so it’s worth exploring whether this applies to your situation if you plan to sell.

Additionally, the special GST apportionment rule for holiday homes was repealed on 1 April 2024. After this date, the general GST apportionment and adjustment rules will apply, which could lead to more complexity in managing the GST obligations for mixed-use properties.

Need an accountant that has their finger on the pulse of tax legislation changes?

Let’s chat!

Income Tax Considerations

On the income tax side, there are some implications related to these changes as well:

- If you are GST-registered, you will account for your income and expenses on a GST-exclusive basis.

- If you are not GST-registered, the flat-rate credit you receive from the platform is considered excluded income, which means it is not subject to income tax. You’ll need to ensure that your income tax calculations reflect this. This does however mean that for income tax purposes you can only claim the GST exclusive portion of all your GST applicable expenses.

Note (October 2024): The rules regarding how non-GST-registered providers can treat the flat-rate credit (and related expenses) are currently in the consultation stage and are subject to change in the future. It’s important to consult a professional to stay informed about any updates. Your accountant can help ensure your filings are compliant and advise on the best reporting methods to maximise your tax benefits.

For properties that are used both for short-stay rentals and personal use, you may need to apportion your expenses between the two, which can require some detailed calculations. An accountant/tax agent should be well-equipped to deal with those complexities and complete your income tax filing, keeping you compliant.

Frequently Asked Questions

Income from short-stay accommodation activity must be reported in full, even if the property has multiple owners. The profit/loss (calculated as income minus expenses) is divided among the owners. If a profit is made, each individual’s tax is based on their share of the profit and their personal tax rate.

Example A:

Jill and Bill jointly own a second property in Nelson, which they rent out on Bookabach year-round. The short-stay accommodation generates an annual income of $50,000, with total expenses of $32,000. This leaves a taxable profit of $18,000. Since the property is jointly owned, the profit is split equally—$9,000 each. Jill and Bill then pay tax on their respective $9,000 shares at their individual tax rates.

Example B:

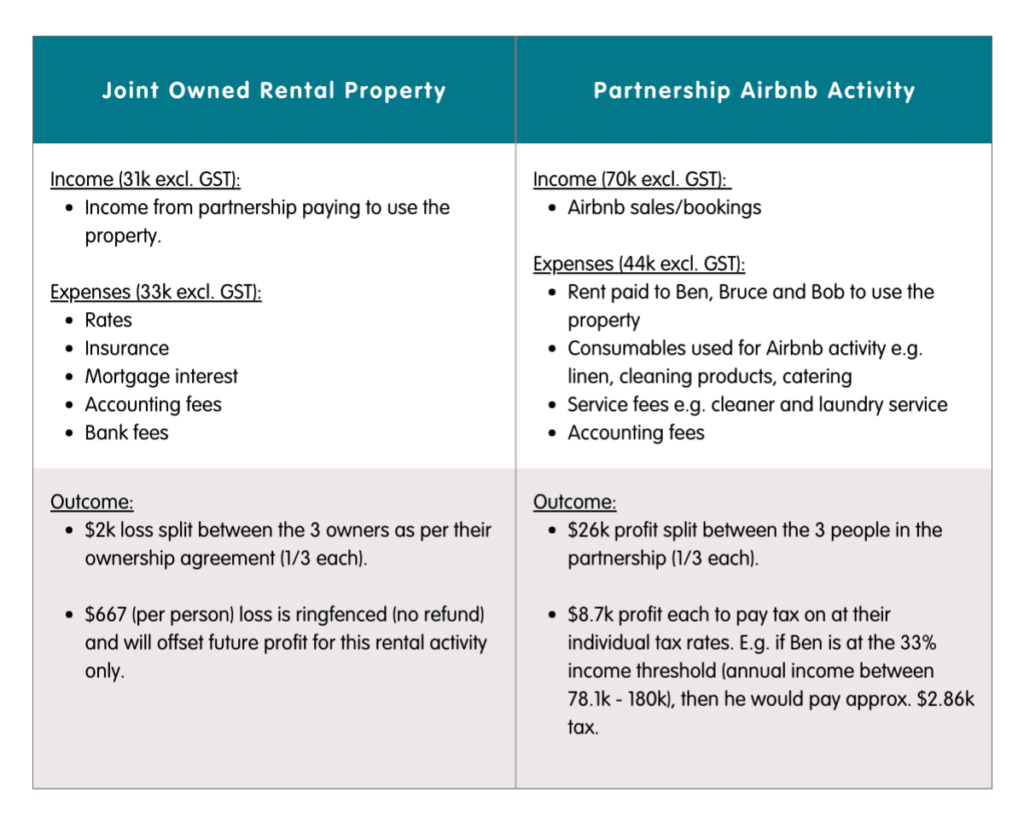

Bob, Ben and Bruce jointly own a property in Christchurch with two dwellings, purchased in 2016. Bob, Ben and Bruce live in the dwelling in the front of the property and they rent out the separate dwelling at the back of the property year round on Airbnb. The rear dwelling brings in an annual income of $70,000 (excl. GST), which requires them to register for GST. Since they can’t be GST registered as joint owners for this activity, their accountant advised them to set up a partnership/company and register for GST. Bob, Ben and Bruce decided a partnership would be the best fit for them.

Bob, Ben and Bruce have a tenants in common agreement stating they own equal thirds in the property. Now that the rental activity maybe say Airbnb activity rather than “rental” will be run through the partnership, the joint owners Bob, Ben and Bruce will be ‘leasing’ the property to the partnership to use to generate short-term accommodation income.

Each year Bob, Ben and Bruce’s accountant will complete two sets of accounts.

Next Steps: What Should You Do Now?

- Check Your Status: Ensure the platforms you use have your correct GST registration status and other relevant details. If you become GST-registered in the future, you must notify the platform to avoid errors.

- Review Your Pricing: If you are not GST-registered, consider how the additional GST cost will impact your pricing. You may need to adjust your rates to account for the 6.5% reduction in income after GST is withheld.

- Seek Advice: The new rules are complex, particularly for larger operators or those managing multiple properties. It’s recommended that you consult with a tax professional to ensure you are fully compliant and optimising your tax situation.

Conclusion

These recent GST changes represent a significant shift for short-stay accommodation providers in New Zealand, and it’s essential to be prepared. By understanding how these rules will impact your income, tax obligations, and the way you interact with platforms like Airbnb, you can take action to ensure your 2025 financial year reporting will go smoothly.

If you have any questions or need tailored advice, don’t hesitate to reach out to your accountant or tax advisor. Being proactive now will help you avoid surprises later and ensure your business stays compliant with the new rules.

About Kiwitax – Award winning business improvement, tax and accounting service

Here’s the thing. As a business, rental property owner or start-up, you get a kick out of having your own gig. But chances are dealing with your tax and accounting leaves you cold. Good news! We love it, so hand it over to Kiwitax and we’ll look after it all for you.

Whether you deal with us online, by phone or drop into our Napier office, you’ll find a friendly, professional hardworking team ready to work with you, however you keep track of your financial information and from wherever you do business. And all for a fixed price. It takes just two minutes to get a quote.

Plus if you’re at a loss to know how to improve aspects of your business – from growth planning to cashflow management, even tax debt and so much more – we’re all over that too. Our Business Improvement advisors can help you make a plan and put it into action.

Disclaimer:

The information provided in this article is intended as a general guide only and may not cover all aspects relevant to your specific situation. Tax laws and regulations can be complex and subject to change. We strongly recommend seeking personalised advice from a qualified accountant or tax professional to ensure compliance and to make decisions best suited to your individual circumstances.